The recently published Petrofin Research ©, which can be accessed at www.petrofin.gr, demonstrates the ability of Greek shipping to continue growing and investing in shipping via younger fleets despite the highly adverse markets and the lack of bank ship finance.

Greek owners increased their share of the world fleet (Source UNCTAD) from 15.41% in 2014, 16.05% in 2015 and 16.36% in 2016.

TABLE 1

| Top nationalities owning over 1% of World Fleet | 2016 | 2015 | 2014 | Annual Rate of Growth |

| Greece | 16.36% | 16.05% | 15.41% | 3.05% |

| Japan | 12.78% | 13.19% | 13.46% | -2.57% |

| China | 8.87% | 8.74% | 9.47% | -3.24% |

| Germany | 6.65% | 7.13% | 7.56% | -6.19% |

| Singapore | 5.32% | 4.97% | 4.75% | 5.84% |

| China, Hong Kong SAR | 4.88% | 4.63% | 4.15% | 8.39% |

| Korea, Republic of | 4.40% | 4.60% | 4.60% | -2.20% |

| United States | 3.36% | 3.45% | 3.35% | 0.20% |

| United Kingdom | 2.88% | 2.85% | 2.73% | 2.64% |

| Source: UNCTAD Petrofin Research © December 2016 | ||||

Its biggest competitors, Japan, China and Germany have not done so well as can be seen in the table above.

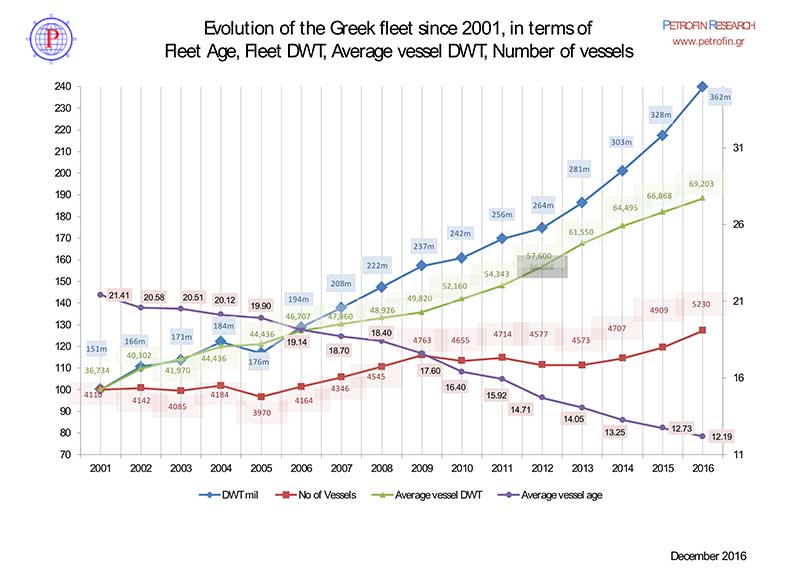

With growth of 6.5% in vessel numbers and 10.26% in DWT terms Greek shipping continued to power forward. Please see Graph 1.

GRAPH 1

What are the reasons that may explain the large rise in both vessel numbers and fleet DWT at such challenging times?

Some explanations can be found in the following:

• Many Greek owners had committed newbuilding orders which were delivered even though there have been significant delivery delays as a result of revised agreements with the shipyards.

• In comparison to newbuilding prices, second hand vessels represented a better buying opportunity and Greek owners switched their attention to purchasing modern second hand vessels.

• A number of Greek owners remain committed to building their eco fleets and to snap up any newbuilding resale opportunities.

• Especially for dry bulk owners, there is a widespread belief that the worst is over and acquiring modern vessels represents an opportunity.

• Private equity funds have begun once again to conclude Joint Ventures with Greek owners especially in the dry bulk sector.

• Greek owners have increasingly made use of their cash reserves to purchase vessels on a cash basis.

Let me highlight some of the key findings of the research:

1. The number of Greek based/owned companies continues to decline down to 638. Considering the level of financial difficulties encountered by Greek shipping, this fall is modest.

2. 25+ vessel fleets constitute now well over half of the Greek total in DWT terms (65.38%), and the number of companies that run them has grown to 46 compared to 41 in 2015. These fleets are also getting younger.

3. The very young fleets (0-9 years of age) continue to rise. They hold 73.56% of the whole of Greek fleet DWT compared to 73.47% in 2015. This shows the commitment of Greek owners towards younger vessels.

4. Over the last 19 years of Petrofin Research, the overall number of Greek companies has declined by over 31%.

5. The overall age of the fleet keeps falling and it now stands at 12.19 years.

As one may observe, there is a clear trend whereby the fleets are getting larger but the number of companies is remaining virtually the same. In all three sectors there is strong evidence of economies of scale at work whilst the age momentum continuously supports younger vessels. The LPG fleet, has become the star performer across all sectors with the number of companies operating fleets of over 20,000 DWT growing from 6 to 13, the total fleet DWT has nearly tripled from 1.078m DWT to 2.950m DWT over the last 4 years. The number of vessels has risen from 23 to 66 and even more remarkably the average age of the LPG fleet has fallen from 13.69 to 4.33 years.

The growth story, however, contains some elements of distress among the smaller fleet sizes, as many companies experienced negative cashflows and the increasing reluctance of banks to provide further restructures. The 68 largest Greek companies increased their Greek fleet share to 65.38%. Greek owners have also taken advantage of the sale of modern vessels by bank promoted sales, increasingly by German banks and owners.

These sales are usually not supported by soft financing as the banks are looking to exit shipping and reduce their loan portfolios. En bloc loan portfolio sales have not materialized to the extent anticipated by the market as the discounts offered to banks have not largely met the banks’ expectations.

The current Greek orderbook now consists of approximately 307 vessels (Clarkson’s World Fleet Register). As deliveries approach, owners are invariably looking for leasing from the Far East, an area where Chinese leasing companies have exceled with Japanese banks/leasing companies joining this trend in 2016 for the top owners. The fall in the tanker market has brought this market also to the attention of private investments funds. Although activity had slowed down in 2016, as the year closes, there is considerably more interest in dry bulk by such funds. IPO activity, however, remains slow as no public companies have escaped the assault on their share prices as a result of weak earnings and value impairments. However, we believe that there is a change in the wind, especially for dry bulk shipping and we would expect more activity in this sector from the public markets coupled with a recovery in company share prices.

International trade growth has been lackluster and the recent trends towards nationalism and trade protection have added further clouds on the global economic growth outlook. Hence, the shipping industry is not expected to experience boom conditions in 2017, even though there has been a modest improvement lately across most sectors.

Greek shipping, having invested massive amounts of capital, needs to digest its gains and continue to grow selectively and qualitatively. It would not be surprising for fleet growth to slow down as newbuilding deliveries slow down. However, the interest by Greek owners in modern second hand vessels has been considerable and this should ensure a yet further solid performance in 2017.

* Head Petrofin Research