Modern containerships are highly complex floating systems that, for the past 50 years, have been trimmed for high performance in terms of safety and availability.

Their development is still far from over. Container shipping is being driven by world trade in a way no other transport system is, and unlike any other system it is in itself a powerful motor to trade. Asia’s economy boom could not have been handled without container shipping.

The increase of containership size seems to be an endless process without any foreseeable limit. Over the past 40 years any estimated limit turned out to be an underestimation in a very short time.

The economies of scale remain a crucial factor in increasing the containers capacity and sizes. The bigger the ship, the lower the transport costs. The introduction of Very Large Container Vessels (VLCVs) and Ultra Large Container Vessels (ULCVs) changes shipping patterns and requires port expansions and port adjustments.

Even in the present situation with a historic volume of oversupply of container tonnage, we are still facing a flood of newbuildings of sizes, which have been never seen before.

INCREASE IN SIZE AND CAPACITY OF CONTAINER SHIPS OVER THE YEARS

The growth of containerization over the past half century has been exponential. Container ships have been getting bigger because the increased size affects positively their operating efficiency, profitability and friendlier environmental performance (Figure 1).

Figure 1: Growth in size of containerships during the last 50 years.

One criterion for dividing container vessels in particular categories is, if they can be accommodated by the Panama Canal. Here we have the following categories: Panamax CVs (3,000-5,000 TEU), Post-Panamax CVs (5,001-10,000 TEU) and New-Panamax CVs (10,001-14,500 TEU).

In literature two terms are often used for the largest ‘’mega-ships’’ in the world: Very Large Container Vessels (VLCVs) and Ultra Large Container Vessels (ULCVs). As there is no commonly accepted definition of VLCVs and ULCVs, for the purpose of this paper we have assumed that vessels between 10,000-14,500 TEU are VLCVs (or New-Panamaxes).

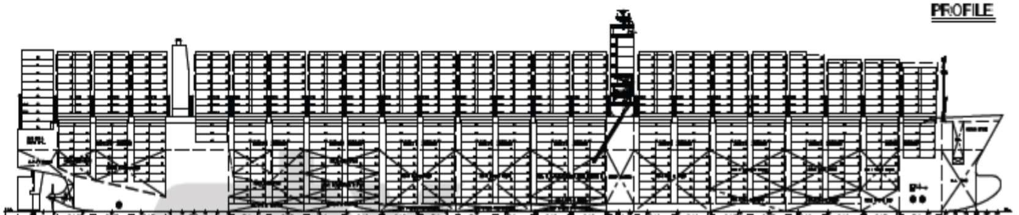

ULCVs are having a capacity of 14,501-21,000 TEU, an overall Length of max 400.0 m, and a max Beam of 50.0-60.0 m (Table 1).

Table 1: Containerships’ categories & main dimensions

|

Name |

Capacity (TEU) |

Length o.a. (m) |

Beam (m) |

Depth (m) |

Draught (m) |

|

Ultra Large Container Vessels (ULCV) (with 12 tiers in Hold) |

21,000 |

400 |

55.60 |

33.2 |

16.0 |

|

ULCV (with 11 tiers in Hold and 11 tiers on Hatch) |

19,550 |

400 |

59 |

30.3 |

16.0 |

|

ULCV (with 11 tiers in Hold and 10 tiers on Hatch) |

14,500-18,200 |

397-400 |

50-59 |

28-30.3 |

15-15.5 |

|

|

10,001-14,500 |

366 |

49.00 |

26-28 |

15.0 |

|

Post Panamax |

5,001-10,000 |

300 |

43.0-49.0 |

22-27 |

14.5 |

|

Panamax |

3,001-5,000 |

213-235 |

32-37 |

19 |

12.5 |

Note: After VLCVs and ULCVs entered the market, the category of feeder vessels has been adjusted from 700-1,500 TEUs to cover also the range of 2,500 TEUs to 3,000 TEUs.

The fast growth in size of containerships has started in June 2011 with the ordering of twenty (20) new Class ‘’Triple E’’ containerships, of 18,270 TEU capacity each by Maersk shipping, the world’s largest containership. Maersk claimed that the ‘’Triple E’’ was the most environmentally friendly ship (the three E stand for economy of scale, efficiency and environmental friendliness). Putting more containers on a ship with less fuel consuming engines would definitely save costs and bring the liner in a much better position in a very competitive market. Designed to be only three meters longer and 3 meters wider than the 15,500 TEU Emma Maersk, it increased the carrying capacity by 16%.

Triggered by Maersk decision to build the first set of Triple-E-Class ships and while it was believed that the Triple-E-Class ships would mark a record for a long period of time, more and more shipping companies have reacted by ordering larger container vessels (over 14,000 TEU), in order to increase their profitability and maintain or even strengthen their market position.

Still in 2014China Shipping has put the ‘’CSCL Globe” of 19,000 TEU into service. “MSC Oscar’’ entered the Europe-Far East trade in early 2015 with 19,224TEU capacity being the world’s biggest containership by today. «MSC Oscar’’ was initially specified at 18,270 TEU but expanded during the building period, as one extra tier was added. (See Chapter 3 below).

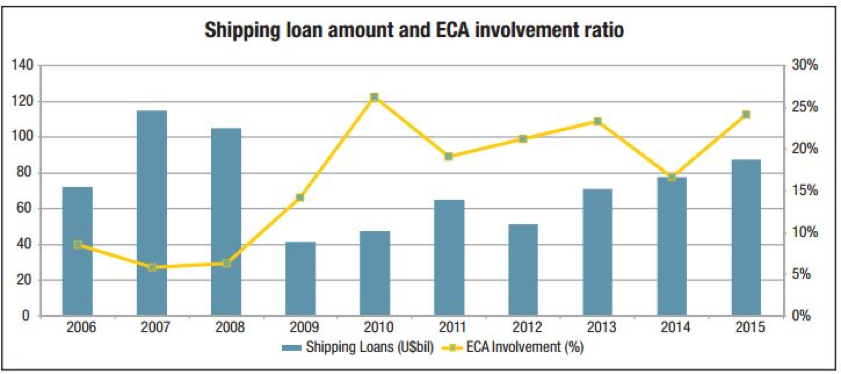

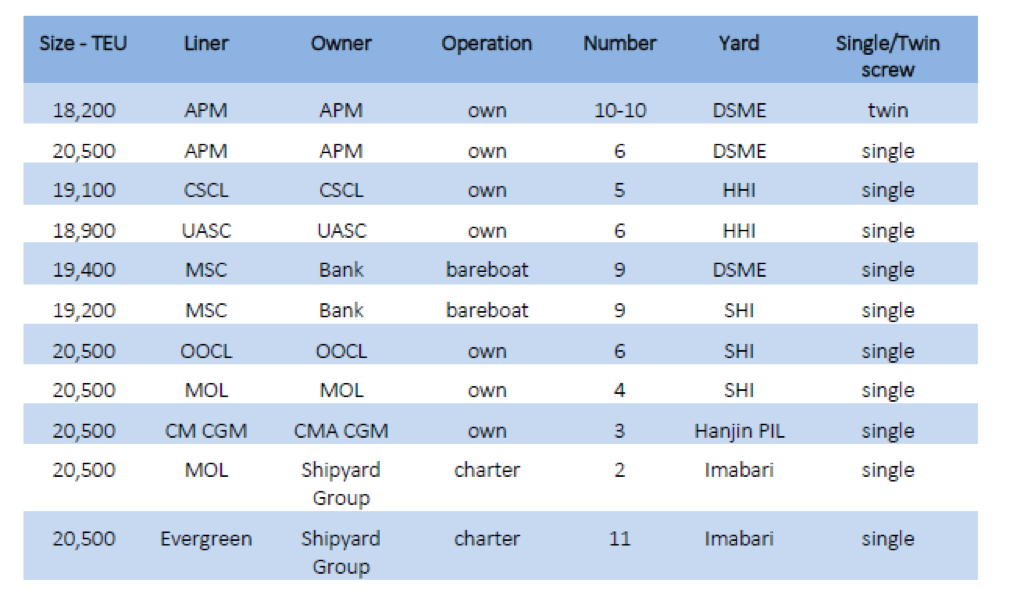

In 2014, there was solid interest in the 14,000 TEU containerships, but the recent interest and ordering of new container ships of liners has been focusing on the 18,000 + TEU ships. Today, more than 100 vessels of this size, or even higher, are on order or in operation (Table 2).

Table 2: Ultra Large Container Vessels in trade or under construction

The average size of containerships has continuously grown over the years from 1,820 TEU in 2001 to 2,425 TEU in 2007 and now reaching, with the construction of VLCVs and ULCVs of over 10,000 TEU and 18,000 ++ TEU respectively, the average size of more than 3,800 TEU.

It has to be acknowledged that we have already experienced limits of growth in other fields of shipping and shipbuilding some time ago. I.e., only two crude oil tankers have surpassed the mark of 500,000 dwt for a short time. No other tanker has come close to this limit since then. Although the shipbuilding industry could have delivered even bigger vessels the limited flexibility to access ports with the big volume of required cargo per shipment have refrained tanker owners from further making use of such mega vessels. The maximum size now is down to 320,000 dwt again. Therefore, a wide adjustment of the ports to the bigger tanker sizes has not taken place.

The case is different in container shipping. The ordering of continuously larger and larger containerships reaching capacities in the region of 20,000 TEU was originally initiated by the need to improve profitability through economy of scale meaning reduction of unit cost and slot cost advantage. Another significant reason is the strong competition among the shipping liners in a very depressed market and in effort, by many of them, to weaken the dominance of Maersk and MSC.

In September 2016, the global containership fleet reached a capacity of 20,267 m TEU corresponding to a total number of 5,150 container ships of all sizes. It took less than 10 years to double in capacity and reach this new milestone.

CAPACITY INCREASE BY MODIFYING EXISTING DESIGNS

a) Designers and shipyards have managed to raise the ship cargo capacities of VLCVs and ULCVs without having to increase their breadth or length. By lifting the deckhouse in order to ensure visibility, shipyards have been able to deliver ships with up to 11 tiers of containers on the hatch coves, in addition to 11 standard containers in the hold. That extra tier, compared to stacks of 10 containers on the hatches for an 18,200 TEU ship, raises the capacity to around 19,550 TEU. Over the years the number of containers on top of the hatch covers has risen from 9 to 11 tiers. The liners MOL, OOCL, China Shipping and Evergreen took this progression one step further by lifting the deckhouse even more by placing 12 tiers in the hold increasing this way of capacity to around 20,000TEU

b) The capacity can be further boosted from 20,500 TEU to 21,400 TEU by adding an extra row across the deck and increasing the beam from, say, 58.6m to 61.1m. Finally, by lengthening the ship with one 40ft bay the container capacity will increase to 22,400 TEU.

The above design changes in number of tiers, bays and rows without major changes in vessels design and structure is reflected in the table below (Figure 2).

|

TEU |

Capacity adjustment |

Lbp (m) |

B (m) |

H (m) |

Tsc (m) |

|

18,200 |

Original:11tier in hold and 10 tier on hatch |

379.0 |

58.60 |

30.3 |

16.0 |

|

19,450 |

11tier on hatch |

379.0 |

58.60 |

30.3 |

16.0 |

|

20,400 |

12 tier in hold |

379.0 |

58.60 |

33.2 |

16.0 |

|

21,360 |

one more row |

379.0 |

61.15 |

33.2 |

16.0 |

|

22,410 |

one more 40´bay |

379.0 |

61.15 |

33.2 |

16.0 |

Figure 2: Increase of TEU capacity by increasing tiers, rows and bays.

LIMITS IN THE MAIN DIMENSIONS

Although the trend to further lengthen and widen ULCVs above 18,000 TEU has calmed down due to the present market situation and world economy, the interest for even bigger ships still persists. However, ports and canals impose restrictions on the draught, breadth and length of vessels. The structural stability limiting the container ship sizes plays also a major part and it takes some in-depth investigation to determine, where to put limits for the main parameters: ship length, ship breadth, and ship depth/draught.

The increase of the length has a direct effect on the increase of the still water bending moment by a power of two. This means that the plate thickness and grade of steel to be used in the upper girder is to be of the appropriate thickness and quality in order to absorb the additional stresses (Chapter 5 below).

The maximum overall length of the presently trading or under construction ULCVs is 400.0 m

The increase of the Breadth of containerships due to today’s slow steaming (18-20 knots) and extra slow steaming (15-18 knots), to save fuel consumption, has much less effect on the longitudinal strength (linear) than the lengthening of the vessel (by a power of two). However, the main setback by widening of a vessel is the more severe rolling motions in seaway and the considerably stronger transverse acceleration forces, affecting the permissible loads of the lashing equipment.

The maximum Breadth of the presently trading or under construction mega container vessels (VLCVS and ULCVS) is in the region of 60.0 m.

The Depth of a containership depends on the number of containers it carries in the hold, the height of the hatch cover and the space between the top of the containers and the lower side of the hatch cover.

The loading condition inside the holds and on hatch covers is a key item in the contracts between shipowner and the yard. According to ISO 1496/1, the lowest container in the hold maybe over stowed by 192.0 tons, which would result in an average container weight of 31 tons for 40’ containers, or 28 tons in the case of 11 tiers, which is equivalent to the typical 14-tons homogenously loading condition.

The maximum depth of a presently under construction 21,000 TEU container ship with 12 tiers in the holds, is 33.2 meters.

Three different draught concepts can be evaluated for containerships: the design draught, the scantling draught and the operational draught. Traditionally the design draught is used for contractual issues such as speed and cargo capacity while the scantling draught is the basis for all international regulations and class rules.

For example, the design draught of a 13,000 TEU containership is between 14.0m and 14.5m while the scantling draught is generally 15.5m to 16.5m.

The operational draughts are used to calculate the specific fuel consumption at various loading conditions.

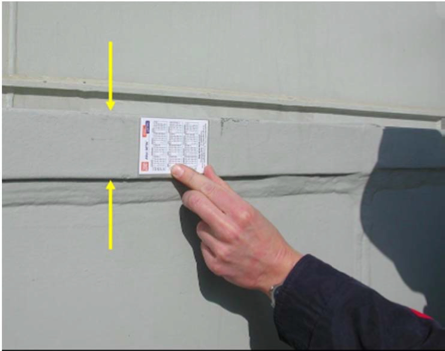

NEW CHALLENGE: EXTREMELY THICK PLATES IN THE UPPER HULL GIRDER

While the demand for container liners exceeding 20,000 TEU persists, technical challenges remain, in particular those relating to the maximum plate thickness in the upper hull girder (Figure 3). In using heavy or extremely thick plates, sufficient attention has to be paid to deterioration of safety and structural integrity due to decline in brittle fracture resistance, increase in ship weight and increase in welding works. Fracture toughness is particularly required for these extremely thick plates (>50.0 mm) to ensure the safety of the hull structure and suppress brittle fracture, which leads to catastrophic sea accidents.

Figure 3: 18,000 ++ TEU Containerships: Maximum plate thickness (85-95mm) and quality of steel (grade YP460) on the upper hull girder.

As for the safety against the brittle fracture, it is pointed out that in addition to the prevention of the occurrence of the brittle crack, prevention of crack propagation is very important. The safety of a welded structure is secured by equipping the base material (i.e. the extremely thick steel plate) with brittle crack propagation halting capability or termed as arrestability or arrest toughness.

Therefore, heavy thick plates with excellent crack arrest toughness must be used in the hatch coaming and upper deck to suppress brittle crack propagation, even when a crack initiates at the weld joint.

The crack arrest toughness of extremely thick plates for hull structures has been studied at the Japan Welding Engineering Society (JWES).On the basis of the results of the research a guideline was incorporated into the NK Class. In this guideline the minimum arrest toughness or arrestability, Kca, for steel plate thickness between 50-80 mm at -10 degree C is to be 6,000 N/mm 3/2.

In January 2013, the International Association of Classification Societies (IACS) released its Unified Requirements (S 33) for the use of extremely thick plates for max 80.0 mm in thickness.

Taking the above background into consideration, Nippon Steel Sumimoto Metal Corporation has developed the YP 460 steel (yield strength 460 N/mm2), which has higher strength than the conventional YP 390 steel (390 N/mm2), with excellent arrest toughness and has applied it to actual ships. The excellent brittle crack arrest toughness of the steel grades YP 460 and YP 390 have been achieved with advanced alloy design, optimized rolling and cooling under Thermo-chemical Control Process (TMCP) conditions.

However, the IACS requirements only relate to steel plates with a thickness of 80.0 mm or less. For thicker plates the value of crack arrest toughness is to be specifically agreed with the relevant Class Society.

Therefore, Class NK continued with verification tests by Ultra-Large-scale test specimens in collaboration with the JWES, which simulated the construction of the hatch coaming and upper deck of ULCVs (i.e. with 18,000++ TEU capacity) as part of a joint project. Class NK concluded that the minimum brittle crack arrest toughness, Kca, for 100 mm steel plates of YP 460 steel grade, used in the construction of ULCVs, must be 8,000 N/mm 3/2 at -10 degrees C. It is highly likely, that this requirement will be incorporated into the IACS Unified Requirements as well.

The actual plate thickness of the presently trading or being under construction ULCVs of 18,000-21,000 TEU capacity are as follows:

• Plate Thickness between 85.0-95.0 mm Grade YP460: in way of hatch coaming.

• Plate Thickness between 80.0-90.0 mm Grade YP390: in way of main deck

• Plate Thickness between 65.0-85.0 mm Grade YP390: in way of shear strake ad longitudinal bulkheads.

FUEL CONSUMPTION - SLOW STEAMING

Most of the containerships presently in trade or under construction are designed for a cruising speed of 23-25 knots/hour.

The practice of slow steaming emerged during the financial crisis of 2008-2009 as an international trade mode. The shipping market started to experience an oversupply of shipping tonnage, declining freight rates and increasing fuel prices, slow steaming and extra-slow or ultra-slow steaming was the only solution in order to lower costs by reducing fuel consumption. Slow steaming or extra-slow steaming is the practice of deliberately slowing down the speed of a ship at 18-20 knots or 15-18 knots respectively.

Slow steaming is principally affected by a number of factors such as: freight rates, bunker cost, cargo cost interest rate and environmental cost but basically the most important and dominant factor is the freight rate.

For shipping lines, trying to stay profitable in the present weak freight market, slow steaming has proven a good way, if not the best operating mode for a container ship, to trim operating expenditures. As a response, maritime shipping companies (not only in the containership sector) adopted slow steaming and even extra slow steaming services on several of their routes by reducing fuel costs. Supply chains have simply been synchronized with the decreased shipping speeds.

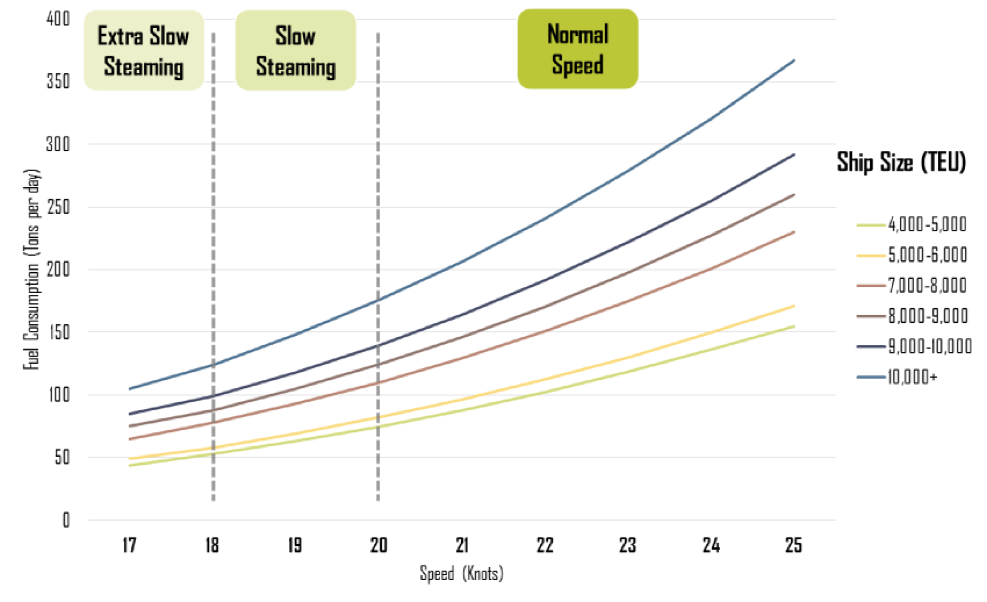

The fuel consumption advantage are obvious on the following Figure 4, by comparing the consumption of a 10,000 + TEU containership trading at two different speeds. At 24 knots speed it would consume 300 tons per day, while at 19 knots around 150 tons per day.

Figure 4: Fuel consumption by Containership size and speed (Source: adapted from Notteboom, T. and P. Carriou (2009).

The Triple-E-Class vessels of Maersk of 18,270 TEU and having 81% more displacement than the so called S-Class of Maersk built 1997 with 8,400 TEU capacity need only 7% more propulsion power as at the same time the top speed of 23 knots is reduced by 2 knots.

However, the advantage of having less fuel consumption and lower costs is mitigated with longer shipping times and engaging more ships, by increasing this way the crew costs, on pendulum service to maintain the same port call frequency.

There are also technical issues to be confronted with such as the lifespan of an existing engine built before the financial crisis, which is expected to decrease due to suboptimal usage. Therefore, slow steaming involves adopting engines that were designed for a specific optimal speed of about 22-25 Knots, implying that for that speed they run at 80% of their full capacity.

Adopting slow steaming requires the ‘’de-rating’’ of the main engine to the new speed and new power level, which involves the timing of fuel injection, adjusting exhaust valves and exchanging a number of mechanical components in the engine.

The new generation ULCVs of 18,000+ TEU are designed specifically to slow steam, as it is expected that slow steaming will be a normal way of operation regardless of the fuel price plunge, at least in the short to medium term.

CHALLENGES FOR PORTS AND SHIPPERS

The introduction of VLCVs and ULCVs has significantly changed shipping and operation patterns for basically all major world routes. The new generation of mega containerships is facing a shrinking number of harbors able to handle them, placing pressures on port infrastructure and equipment. Ports and terminals already make preparations and investments in anticipation of the 50% capacity jump in the last two years from 14,000 TEU (work horses) to the 20,500 TEU containerships.

Currently, there is a need for infrastructure improvement i.e more yard space, larger gates, more manning and possibly investing in larger cranes with longer outreach, additional rail and road capacity in order to deal with the new megaships.

To deal with the volume peaks, VLCVs and ULCVs can only be profitable if they are handled quickly. The consensus among big ship carriers today is that terminals should handle 6,000 moves a day on vessels above 14,000 TEU. This calls for improvements at almost all European ports.

The introduction and deployment of VLCVs and ULCVs will affect main routes, as they will replace smaller containerships, which currently serve these routes. For example some shippers looking for the most economic choice, divert their cargo to Rotterdam, which is served by ULCVs from Hamburg. The reason is the limitation in handling these vessels at the port of Hamburg due to restricted draft.

Nevertheless, ocean carriers will continue to deploy the most efficient size of ships, most likely larger ships, for the particular cargo volume and the particular trade route.

CONCLUSION

It is expected that ship capacities will continue to head upwards, surpassing the 20,000 TEU mark, as lines strive for economy of scale and lower slot cost. There are no immediate technical barriers to larger ships. Most experts predict that boxship sizes will further increase, before, port and land-side infrastructure constrains put a ceiling on slot capacity.

The challenge to marine engineers is to go to the limits of what is technically feasible, without losing sight of the profitability and market situation. To that end, box ship sizes are expected to grow further but maybe at a more moderate rate, than in the last decade. It is believed that container vessels size will not go beyond the current maximum of 400 by 60 meters so that the largest vessels may be able to carry about 20,000 TEU to 23,000 TEU. It is projected that cost savings resulting from increasing ship’s cargo capacity will not justify further vessel size increase at the present market situation and the projected cargo flaws.

* Member of BoD of Box Ships Inc.